NM RPD-41373 2022-2024 free printable template

Show details

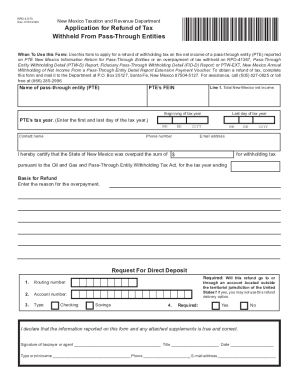

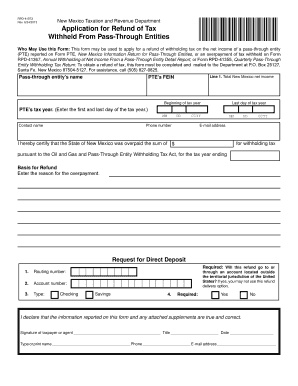

RPD41373 Rev. 06/06/2022New Mexico Taxation and Revenue Department×447480200×Application for Refund of Tax Withheld From Walkthrough EntitiesWhen To Use this Form: Use this form to apply for a refund

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your new mexico withheld pass form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new mexico withheld pass form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new mexico withheld pass form online

Follow the steps down below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit new mexico 41373 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

NM RPD-41373 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out new mexico withheld pass

How to fill out new mexico withheld pass:

01

Start by obtaining the new mexico withheld pass form. You can download it from the official website of the state's tax department or request a physical copy.

02

Gather all the necessary information and documents required to complete the form. This may include your personal information, such as name, address, and social security number, as well as information about your income and tax withholdings.

03

Carefully read the instructions provided with the form. This will guide you through the process and ensure that you are providing the correct information in the appropriate sections.

04

Begin by filling in your personal information accurately and legibly. Double-check that all the details are correct to avoid any potential issues or delays.

05

Move on to the sections related to your income and tax withholdings. This is where you will need to provide details about your employer, earnings, and the amount of taxes that have been withheld from your paycheck.

06

Take your time to review the completed form. Make sure all the information is accurate and there are no mistakes or omissions.

07

If required, sign and date the form in the designated area. This is an essential step to validate your submission.

08

Make a copy of the completed form for your records. It is always good to have a copy in case there are any discrepancies or questions in the future.

Who needs new mexico withheld pass:

01

Individuals who receive income in the state of New Mexico and want to adjust or modify their tax withholdings may require a new mexico withheld pass.

02

This form is typically used by employees who want to change the amount of state taxes being withheld from their paychecks. It allows them to adjust their allowances and ensure the correct amount of taxes is withheld based on their individual circumstances.

03

Self-employed individuals and independent contractors who have income tax obligations may also need to utilize the new mexico withheld pass to calculate and remit their estimated tax payments.

Overall, anyone who wants to ensure accurate and appropriate tax withholding in the state of New Mexico may find it necessary to fill out and submit the new mexico withheld pass form.

Fill new mexico rpd application tax pass : Try Risk Free

People Also Ask about new mexico withheld pass form

What is the pass-through withholding rate in New Mexico?

Do I need to file New Mexico tax return?

How much should I withhold for New Mexico state taxes?

What is the form 41367 in New Mexico?

Does New Mexico have a withholding form?

What is a RPD 41359 form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file new mexico withheld pass?

In New Mexico, the employer is required to file the New Mexico Withholding Pass (Form PTE) on behalf of the employees. This form reports the wages subject to New Mexico withholding tax and the amount of tax withheld. It is the employer's responsibility to accurately complete and submit this form to the New Mexico Taxation and Revenue Department.

How to fill out new mexico withheld pass?

To fill out the New Mexico Withholding Tax Form (pass), you will need the following information:

1. Employer Information: Include your employer name, address, federal employer identification number (FEIN), and your New Mexico employer's identification number.

2. Employee Information: Provide your personal details including your full name, address, and Social Security number.

3. Withholding Status: Select your marital status (Single, Married, or Head of Household) and the number of exemptions you are claiming.

4. Additional Withholding: If you wish to have additional taxes withheld, specify the extra amount you want deducted from each paycheck.

5. Signature: Sign and date the form to acknowledge the accuracy of the information provided.

Once all the required fields are completed, submit the form to your employer, who will use this information to calculate and withhold the correct amount of state income tax from your wages.

What information must be reported on new mexico withheld pass?

To answer this question accurately, I would need more specific information about the context of "New Mexico withheld pass." However, if you are referring to the income tax withholding requirements for New Mexico, the following information would typically need to be reported on the state withholding form:

1. Employer and Employee Information:

- Employer name, address, and identification number

- Employee name, address, and Social Security number

2. Federal Tax Information:

- The federal withholding amount for the employee

3. State Tax Information:

- The amount of wages subject to state withholding (typically the same as federal wages)

- The state withholding amount calculated based on the employee's exemptions, filing status, and tax rates

It is important to note that specific requirements and forms may vary depending on the state's tax regulations, so it's always advisable to refer to the official New Mexico Taxation and Revenue Department website or consult with a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of new mexico withheld pass?

In New Mexico, if a person fails to file their withheld pass within the specified deadline, they may be subject to penalties. The penalty amount is determined based on the individual's unpaid or underpaid tax liability and the duration of the delay. The penalty for late filing can range from 1% to 25% of the unpaid tax for each month the return is late, and the maximum penalty is capped at 25%.

It is important to note that penalties and interest for late filing can accumulate quickly, so it is advisable to file the withheld pass as soon as possible to avoid further financial consequences.

How can I send new mexico withheld pass form to be eSigned by others?

Once you are ready to share your new mexico 41373 form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I edit new mexico rpd 41373 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign rpd tax through form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Can I edit new mexico refund tax withheld form on an Android device?

You can make any changes to PDF files, like new mexico refund withheld form, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your new mexico withheld pass online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Mexico Rpd 41373 is not the form you're looking for?Search for another form here.

Keywords relevant to new mexico rpd 41373 form

Related to new mexico pass through form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.